China Races for Chip Supremacy

This year, China will add more new semiconductor-production capacity than the rest of the world combined, all for mature-technology chips.

The impetus for this self-reliance campaign stems from recent export curbs from the United States, Japan, and the Netherlands that restrict China’s access to high-end chipmaking tools. This has served as a wake-up call for China’s domestic industry, spurring a surge in investment and experimentation. This year, the country is on the way to adding more chip production capacity than the rest of the world combined, primarily for mature-technology chips.

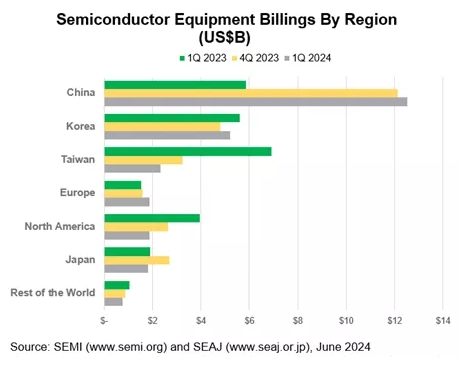

According to industry group SEMI, In 2023, China defied the global trend and became the world’s top spender on semiconductor equipment, investing over $36 billion for it.

Still, China is much less able to exploit its dominant semiconductor supply chain position than the U.S., says Antonia Hmaidi, senior analyst with the Mercator Institute for China Studies, largely because of its dependence on Western chip-making equipment.

“Boosted by government funding and other incentives, China is expected to increase its share of global semiconductor production,” according to SEMI. “Chinese chip manufacturers are forecast to start operations of 18 projects in 2024, with 12 percent YoY capacity growth to 7.6 million wpm [wafers per month] in 2023 and 13 percent YoY capacity growth to 8.6 million wpm in 2024.”

At the forefront of this race is Semiconductor Manufacturing International Corporation (SMIC), China’s leading chipmaker. SMIC’s new production line on the outskirts of Beijing shows the country’s ambitions. The company is integrating domestically produced equipment into its manufacturing process, gradually replacing industry-standard foreign tools. This audacious move, codenamed “Delete A” or “Decouple From A,” reflects a broader national strategy to free China’s technological future from foreign dominance. In December 2020, SMIC was included on the U.S. export blacklist over alleged links to the Chinese military.

According to its 2023 financial report, SMIC increased its property, plant, and equipment assets to $24 billion, up from $18.8 billion in 2022. Furthermore, last quarter, SMIC added $1.5 billion in equipment.

In fact SMIC, in Q1 2024, ranked third on TrendForce’s list of top global foundries after overtaking GlobalFoundries and UMC. SMIC benefitted from inventory replenishment for consumer products and the tendency of localized production. SMIC generated $1.75 billion of revenue in Q1 with QoQ growth of 4.3 percent, and surged to 5.7 percent market share.

“Resurgent market demand and increased government incentives worldwide are powering an upsurge in fab investments in key chipmaking regions and the projected 6.4 percent rise in global capacity for 2024,” said Ajit Manocha, SEMI president and CEO. “The heightened global attention on the strategic importance of semiconductor manufacturing to national and economic security is a key catalyst of these trends.”

Headwinds and hurdles

China’s significant investment in its chip ambitions faces considerable challenges. It has made progress in chipmaking but needs help to create a complete domestic industry. While its 28-nanometer production line is impressive, it falls short compared to the more advanced 3-nanometer chips used in latest high-end mobile devices. While breakthroughs have occurred, such as Huawei allegedly developing a 7-nanometer chip using SMIC technology, these advancements might be achieved through unconventional methods. They may not be commercially sustainable in the long term. Engineers are concerned that these techniques could be inefficient and costly to scale up.

China also needs advanced lithography machines for intricate circuit production, relying on equipment from other countries, mainly from ASML in the Netherlands. However, the U.S. and its allies have restricted access to these machines, prompting Chinese companies to develop their own equipment. As a result, there has been a surge in Chinese companies contending for customers by offering competitive deals.

“By blocking everything, you force the sleeping lion to wake up,” Konrad Kwang-Leei Young, a former executive at TSMC, told the Wall Street Journal.

Additionally, China is stockpiling foreign equipment to secure a supply. This situation presents a complex compromise of technology and trade.

The global playground

China’s chip race is not happening in isolation. The global semiconductor industry is witnessing a surge in investment as governments worldwide recognize the strategic importance of chip technology. The U.S. has earmarked over $50 billion to bolster domestic chip production, and the European Union followed suit. Furthermore, South Korea, home to Samsung and SK Hynix, recently announced a $19 billion tax incentive to strengthen its chip sector.

A bumpy road to self-sufficiency

China’s chip ambitions are audacious and significantly affect the global technological landscape. While the country is making strides in building a domestic chip ecosystem, the path to complete self-sufficiency remains long and full of challenges. China’ gamble success hangs on overcoming technological hurdles, navigating geopolitical tensions, and fostering an innovative, efficient, and cost-competitive domestic chip industry.

Can China go it alone in the chip world? Only time will tell. They’ve got the money and the motivation, but the tech hurdles are steep. The next few years will be a test to see if they can turn their chip dreams into reality.